Good News: Italy is Again a Creditor Country

Italy has re-entered the small group of foreign creditor countries. Even with the pandemic, our credit position and therefore financial stability has improved. The ECB's purchase program has favoured the activities of companies and households.

Foreign assets exceeding liabilities

In its latest report on the foreign accounts of our economy, the Bank of Italy certified an important change: "At the end of September 2020, Italy's net foreign position was marginally in credit by 3.1 billion euros (0.2 per cent of GDP), after more than 30 years of continuous negative balances. The improvement with respect to the end of June, equal to 31.7 billion, is due for more than three quarters to the current account surplus".

For the first time since the mid-1980s, Italy has returned to having foreign assets in excess of liabilities. This result is the result of the narrow path, aimed at achieving greater financial stability, that our economy took in response to the so-called spread crisis. In fact, although Italy's foreign debt position has never reached or exceeded the 35 per cent of GDP set by the European Commission as the limit for macroeconomic imbalance, the Commission itself had to note that "the developments that occurred in Italy in 2011-2012 show that even a slightly negative net international investment position can make a country vulnerable to a reversal of foreign capital inflows, with negative repercussions for the economy". This confirms the thesis that countries with a negative net international investment position (NIIP) are more frequently subject to a loss of market confidence, resulting in a sudden stop in capital flows, default or restructuring of foreign debt and recourse to financial assistance from international bodies (IMF, World Bank or MES).

In order to understand how the Italian economy managed to return to a foreign surplus, it is necessary to look at current account and capital account flows accumulated in recent years. Net of valuation adjustments, the change within a given timeframe is equal to the current account and capital account balance recorded over the same period.

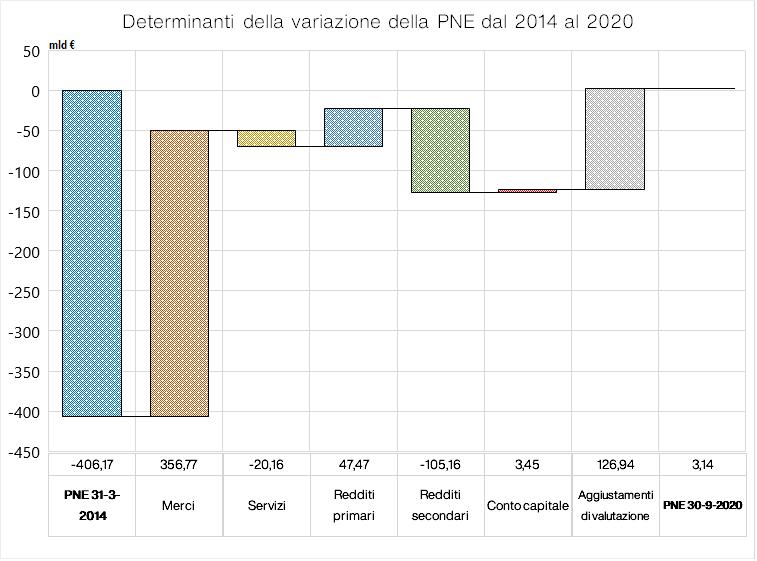

Figure 1 - Determinants of the change in Italy's net international investment position from Q1 2014 to Q3 2020. Data in billions of euros.

Source of data: Banca d’Italia

Breakdown by sector

As can be seen from Figure 1, the greatest contribution to the improvement in the Pne is linked to trade in goods. Weak domestic demand in recent years has compressed imports, bringing them well below the level of exports. The "Goods" account of the balance of payments recorded a surplus of around 357 billion euros from 2014 to the third quarter of 2020.

Another important positive contribution came from the "Primary Income" account. For a country that is a net debtor and has no capacity as a global financial center, one would expect primary incomes to be negative, to pay more interest and dividends abroad than it receives. On the other hand, Italy, thanks mainly to the reduction in interest rates resulting from the expansionary policies of the European Central Bank, has for four years now achieved a surplus in this item, which in 2020 will exceed 20 billion euros.

On the other hand, the "Services" account, which also includes flows linked to tourism, and "Secondary income", largely linked to remittances and net transfers to the EU, made a negative contribution. Finally, thanks to an improvement in the valuation of foreign assets or a decrease in the value of liabilities by approximately 127 billion, a positive net international investment position was achieved.

However, it is not evenly distributed among the various macro-sectors of the Italian economy.

The public institutional sectors - state and central bank - continue to have a largely negative net position. Banks, too, still have a debt position, albeit one that has improved considerably from around 260 billion in 2014 and the 400 billion reached during the years of the spread crisis.

On the other hand, the other sectors, consisting of non-banking companies and households, have almost doubled their net foreign assets from 2014 to date, from 546 billion at the beginning of 2014 to 1,087 billion in the third quarter of 2020. In these years, that is, Italians have continued to acquire net foreign assets, also favored by the ECB's purchase program, which has freed up additional liquidity to be invested in foreign securities and funds.

The latest macroeconomic forecasts, even assuming that the fiscal stimulus launched to deal with the effects of the pandemic will lead to a recovery in domestic demand and, therefore, in imports, see the current account surplus of the Italian economy still stable at 3% of GDP. The higher imports should, in fact, be balanced by a similar favorable trend in exports, a recovery in tourist flows and a positive balance in transfers with the EU as a result of the Recovery Fund. Italy's credit position and therefore its financial stability is set to improve. Weaknesses remain linked to the public sector, which is structurally in debt to the outside world, and to the banks, which have not yet recovered a positive Pne. Of less concern is the position of the Bank of Italy, which has worsened considerably over the last 10 years, but this is exclusively due to the balance with the Target2 Eurosystem. A balance that is a consequence of the ECB's monetary policy decisions and that, as repeated on a number of occasions, will have to be adjusted only in the unlikely event that a country decides to leave the single currency.

Even if the values attained by the large manufacturing countries (China, Germany, Japan) are far from being reached, in 2020 Italy has returned to be part of the foreign creditor countries, a "club" that until last quarter counted only eight EU countries and none of the so-called peripheral countries.